What are the benefits of short-term classic car insurance?

Temp classic car insurance can be arranged in a few minutes, with your motor insurance certificate available immediately to download and print.

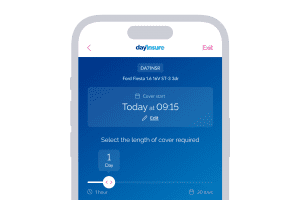

You can choose to have temporary classic car insurance for any period between 1 hour, 1 week, 1 day or 30 days, with European cover as an optional extra. This is perfect for those who own vintage cars, are part of a classic car club and for those considering becoming a classic car owner.

Our temporary car insurance is standalone and protects existing policies in the event of an incident. This means that our car insurance is often cheaper than you may think.

Whether you’re a club member who is planning on testing a Morris Minor, an MG Midget or are looking for temporary cherished car insurance for a friend, our hourly insurance, weekly insurance and monthly insurance policies are a great option. For car enthusiasts, there is nothing better than finding a policy that suits you, which is why our flexible options prove popular for classic car drivers.

Arranging classic car insurance is simple! Underwritten by Aviva, the UK’s largest authorised and regulated insurer, you can be sure you’re in good hands when taking out temporary classic car insurance with us here at Dayinsure.